True Innovation Requires Revolutionary Partnerships

December 13 2023 / 2 Minute Read

This week, we announced a groundbreaking partnership with TIFIN AMP that promises to reshape the landscape of fund distribution. This alliance marks...

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who We Serve

BetaNXT invests in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive, front-to-back securities processing, tax, and investor communications solution.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

No matter how tech-savvy and automated a wealth management firm becomes, there’s always a degree of people and process. This work is required, oftentimes manual and routine, yet very technical and specialized in nature. And all of this is handled by the operations department.

Historically, firms have viewed operations as just a requirement and not a source of differentiation or competitive advantage. They’re a cost center, not revenue driver. Depending on the size of the firm, operations is typically staffed by dozens or even hundreds of people who spend a lot of time engaged in repetitive tasks that, while required and very important, are not perceived to add value.

In addition to having to recruit, train, manage and compensate these employees, firms also struggle to maintain optimal staffing levels. The depth of expertise in the operations workforce has fallen over the years. Today, when someone leaves, it’s difficult to find a skilled replacement in a reasonable time span.

For some brokers, especially those that desire to be self-clearing, these costs and staffing issues must be borne. Some smaller firms simply seek to avoid these challenges and opt to complete transactions by working with major clearing brokers. While this approach can help to alleviate staffing concerns, firms that go this route face high costs and lose control of their customer data. In addition, forgoing clearing and custody responsibilities also result in missing out on significant revenue opportunities.

BetaNXT has a mission to deliver a connected ecosystem that supports wealth management firms end to end, from the initial client onboarding through transaction settlement and ongoing servicing. As part of this approach, we’re delighted to unveil our new Operations-as-a-Service (OPaaS) offering. It’s been created not only to resolve operational challenges but also to introduce capabilities and capacity for firms to add value and grow their business.

The way we see it, three scenarios exist where BetaNXT clients benefit from outsourcing their operations to OPaaS:

BetaNXT is focused on helping financial firms deliver the best experience possible to their clients. OPaaS is another offering that helps us achieve that objective. With OPaaS, wealth management firms benefit from:

This blog post was based on a conversation with the BetaNXT OPaaS Team: Joe Colaizzo, Jason Keppy and James Torquato.

To learn more about how your firm can benefit from BetaNXT OPaaS, fill out the form to arrange a conversation with Joe Colaizzo, Head of Operations as a Service.

December 13 2023 / 2 Minute Read

This week, we announced a groundbreaking partnership with TIFIN AMP that promises to reshape the landscape of fund distribution. This alliance marks...

January 15 2025 / 2 Minute Read

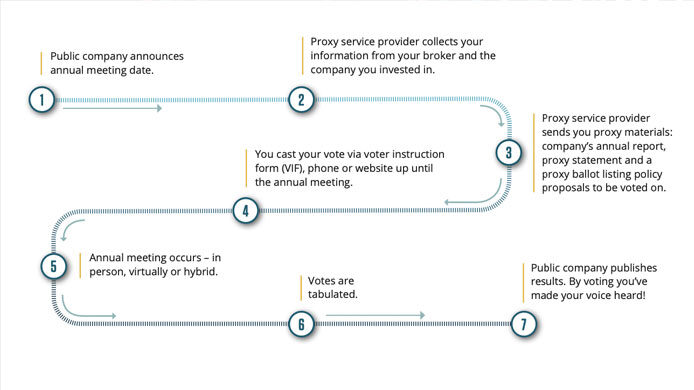

How well do your retail brokerage clients understand their rights as shareholders and the voting process for exercising them?

July 07 2023 / 6 Minute Read

BetaNXT CEO Stephen C. Daffron Discusses SIFMA, Moving To T+1 Securities Settlement, and How Wealth Management Can Use Better Data to Make Better...