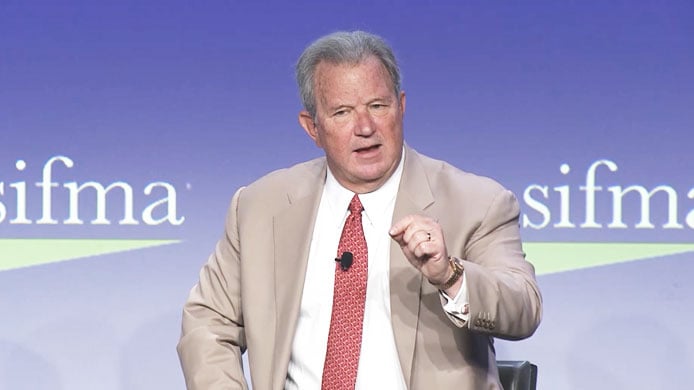

Know Better. Do Better. Stephen C. Daffron at SIFMA Ops 2023

May 16 2023 / 23 Minute Read

As technology supercharges data access and transparency, opportunities to bring the benefits of sound investing to more individuals multiply....

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who We Serve

BetaNXT invests in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive, front-to-back securities processing, tax, and investor communications solution.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

A conversation with Stephen Daffron, Chairman & CEO of BetaNXT and Joe Seidel, Chief Operating Officer of SIFMA on the current shifting investor demand curve and how it is influencing our industry’s focus and ways our industry can support the increased democratization of investing.

I am glad to be joined today by Stephen C. Daffron, co-founder and industry partner at Motive Partners. Stephen serves as Chairman and Chief Executive Officer of BetaNXT, a Motive Partner Portfolio company. Welcome Stephen. Thank you for joining us today. BetaNXT is just over a year old. Can you give me a quick overview of your organization and what you've achieved over the past 16 months?

Thanks, Joe. Good to be here. Good to see you. BetaNXT provides software-as-a-service, data-as-a-service and operations as a service to enable critical advisor and investor workflows for our enterprise clients. We have three business verticals: Beta, which people know for a long time, powers our securities processing and custody operations. And as it does so, of course, it collects, structures, and curates all the requisite data necessary for clearing, settlement, regulatory and client reporting, and all the reporting requirements you'd have for clearing custody service. Maxit, our end-to-end tax and cost basis reporting solution does all that: end-to-end tax basis and cost basis. And Mediant, which powers our digital investor communications shareholder engagement, allows all proxy, prospectus client reporting firms, and confirms driven from that same, highly curated data set, whether resident within BetaNXT or imported from the client. Together, these three verticals support the critical workflows that our clients need to operate as a broker dealer, while solving the complex integration challenges necessary to improve the overall advisor and investor experience.

Now we're just over a year old. We've accomplished a lot in a year — we've moved from batch cycle constraints to real-time information; we are now an end-to-end solutions provider with connected transparent data flows and well over 500 APIs and a cloud offering to support partner integrations. It's an exciting time to be here. We're just getting started.

Indeed…very impressive. The investor demand curve for wealth management and asset management is changing dramatically. Demographic changes are driving intense personalization and a demand for real-time information. Regulations are changing in response. As a result, broker dealers, asset managers, and wealth managers are under pressure to change and to do so rapidly. Can you share your thoughts on the current shifting investor demand curve and how it is influencing our industry's focus?

Like you, I've been looking at this for a long time and these changes in investor demand can be categorized. We see them as three different components, all of which are those same things you just mentioned. They're all being driven by demographic shifts and access to more advanced tools and technology.

First category, the demand for personalized investment servicing, as you talked about, includes advice and access to near real-time performance data. This is driven by a new community of investors who want more visibility into and control over their wealth management strategies — take a look at the recent World Economic Forum whitepaper, and you'll see that these investors are younger, more female, and more diverse than ever before, and their demands are accelerating. Industry changes to accommodate this investor group have to be fueled by technology that both automates and accelerates advisor access. Yes, the data says those younger, more diverse investors still want advisors, but they want access to better, faster customer data. They also want to deploy AI to distribute personalized education and advice to individual investors.

Second, we're seeing a greater demand for more and better products. And you've heard this before, starting with the alternative products to enable better diversification across the investor portfolios. This demand, of course, has to be managed carefully to mitigate the operational and educational risks associated with these riskier asset classes. That too, though, requires additional personalization, particularly within that category of advice. The advisor has to manage these more complex investments will require multiple technology solutions, complex technology solutions to balance that risk and return.

And third category, which is kind of an all-encompassing one, is a demand for digitization and modernization, both with the data and the tools that accompany the investment process. The advisor, who is really where the rubber meets the road, ultimately understand the client's demand curve must be able to take swift and confident action. And they're asked to deliver advice, education, and performance data, but they can only do that if they're provided with digitized data that's available when and where they need it. An example, just think about your normal corporate actions. When do they need that information? How does that client get it? How does the advisor advise them, how they get feedback? Digitization empowers the growing use of predictive analytics. The cleaner the data you have front to back about the frequency with which a customer interacts with their advisor and why, the better you can deploy integrated intelligent answers. Think same day cost basis. We can remember cost basis as being something you got maybe once a year. Now you need at least same day or need real-time cost basis and having same day credit scoring enabling same day tax-optimized trading.

Joe, I know you've surely already noted all these categories that we just talked about are directly related to what you guys at SIFMA, the important work that you're doing to support the industry. The modernization we're all undertaking is just directly supported by the work you're doing to push towards faster and more effective workflows. For example, I'm a big fan of the work you're doing on moving towards mandated e-delivery. We're also exploring ways that we can open access for more investor groups to a broader range of investment options and doing so in partnership with our regulatory colleagues. All this work as well as the important focuses to the SIFMA foundation and the members of the SIFMA board have on educating future generations is what we are collectively driving our strategies for growth.

No, we are very much on the same page and we very much here at SIFMA appreciate your help on these issues, for sure. And we admire your industry thought leadership. Shifting gears here then, you are engaged in the World Economic Forum work that is looking at how investors are demanding more access to private markets. What do you see as the most important ways for our industry to support this increased democratization of investing?

I'm a sort of a lapsed academic, I suppose. I play a small part in the World Economic Forum group that focuses on the Future of Capital Markets, but I’m a very small part. Most of the heavy lifting’s been done by Matthew Blake and Akash Shaw. We released a whitepaper back in mid-2022 about the Future of Capital Markets, and we're about to release the next installment, which focuses on broadening the access to private markets. The paper will focus on financial advice, the democratization of private markets, and financial literacy and empowerment. Again, something that SIFMA cares a lot about. The content's been developed in direct response to the data we collected and the changes we're seeing in the global investor demand.

To summarize that change, we're seeing more retail investors looking to access private markets as part of a diversified portfolio. As a matter of fact, I would go so far as to say they're demanding access to those private markets. There are several reasons for their increased demand, including shifting retirement models and advances in FinTech that let them see more, provide greater individual access to investment vehicles. But the main point is that we, the wealth management industry, we have to understand that there are barriers alongside the benefits for a broader, mass market, investor entry into the private markets.

What are those challenges? Well, they're ones you're familiar with. The challenge that we can collectively see is education. The number one thing that SIFMA is focused on, SIFMA is doing the work, and the foundation and the focus of several board members. I know Joe Sweeney and I have talked about this; David Dawkins and I have talked about this. Education is going to be the key to making the democratization of the private markets better. Regulation, a collegial approach to this — not looking at having top-down solutions — but a collective collegial approach to finding solutions that actually allow the benefit to accrue to the investor. Access: this is, and I know from my other conversations with the super board members, this is a soft spot for SIFMA. Giving people access to the marketplace is a really good thing. I've heard Charlie Scharf talk about this ad infinitum because he always wants to say, giving people access to the marketplace is one of the things that we should be doing in this industry. And of course, suitability, which is the thing our regulatory colleagues will always be talking about. But I think it's our collective responsibility to show that all the above — education, regulation, and access — are done with a clear eye on assuring broader investor classes are engaging with opportunities that don't expose them to unnecessary risk. And that's the responsibility that we as an industry, we as leaders need to take seriously.

Very much appreciate that. And your vision there too for, for all of that. Yes, we very much in line with that. So then, what can our industry do to make progress quickly but responsibly to meet the demands of a changing investor demographic?

First thing I'd say is that we have to do this together. Ultimately, the sum of our industry actions are greater than individual parts. It's tempting because I've been in all parts of this industry. I've been on the investment banking side, I've been on the hedge fund side, I've been on the wealth management side. It's tempting to migrate quickly to innovation and the technology advances on a firm-by-firm basis to meet the demands, get there first and devil take the hindmost, but going too quickly risks abandoning the critical checks and balances to ensure operational safety and the security we've been developing over the years. I mean, Joe, you've seen what’s happened since the years of T+5 to successfully operate on a trusted industry basis that can innovate quickly. We have to be thoughtful about this to ensure operational safety of what we developed over the years.

I've used the metaphor before, I used it with Tom Price back in the spring where I talked about…a long time ago I used to jump out of airplanes. And one of the last things you did before you jumped out of the airplane is you had to check your equipment. And of course, your equipment's behind you. So, you’ve got to check the equipment of the guy in front of you and the guy behind you has to check your equipment. To successfully operate as a trusted industry, we need to track each other's equipment. Before we jump to do T+1 or to do any other major change, we need to check our parachutes. We need to check the straps and shrouds of those other companies in line with us. Why? Because we're in this together. We will succeed or fail together. We need forums like this annual meeting to ask each other the hard questions, to ask each other at every decision point. Are we thinking about the implications to our clients today, tomorrow, in six months, in six years? Are we asking each other the hard questions? I mean, it's easy to slap each other in the back and say, “It's all fine…we're making money.” It's harder to say, “What risks are we taking and are we sure that's the right answer?” We are all here at this meeting with a collective desire to make progress and achieve growth. Our continued ability to look at the opportunities and challenges together, I think is essential to our collective success. Those're my thoughts.

That's terrific. And we very much appreciate your technology, industry, financial leadership, and terrific to give us this time. With that, we are out of time, and we very much thank you for joining us today, Steve, and look forward to watching you grow your company and staying at the forefront there. So very much appreciate. Thank you.

Pleasure, Joe. Thank you.

May 16 2023 / 23 Minute Read

As technology supercharges data access and transparency, opportunities to bring the benefits of sound investing to more individuals multiply....

January 03 2024 / 4 Minute Read

“If you can’t keep up, you can’t play” is a schoolyard taunt now echoing across wealth management. The pace of change in our industry has been...

December 13 2023 / 2 Minute Read

This week, we announced a groundbreaking partnership with TIFIN AMP that promises to reshape the landscape of fund distribution. This alliance marks...