Q&A Blog Series: A True End-to-End Shareholder Meeting Solution

May 03 2023 / 4 Minute Read

Unlike annual shareholder meetings, special meetings of shareholders are called only when a significant, urgent matter arises that needs shareholder...

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who We Serve

BetaNXT invests in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive, front-to-back securities processing, tax, and investor communications solution.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

Learn the genesis of each shortening of the settlement cycle, why T+1 is an event-driven mandate with a higher degree of complexity, and more.

On Tuesday, May 28, 2024, the first trading day after the U.S. Memorial Day holiday, regular-way settlement for U.S. equities, fixed income, and other select products will shorten from the current trade date (T) plus two business day cycle (T+2) to T plus one business day (T+1). A smooth and predictable settlement is essential to the global economy.

The whitepaper T+1: Why This Time Feels Different from T+2 examines how the drivers of the current move to T+1 differ from the 2017 move to T+2 in a few interesting ways that relate to settlement infrastructure. You’ll learn:

Fill out the form to read the whitepaper.

May 03 2023 / 4 Minute Read

Unlike annual shareholder meetings, special meetings of shareholders are called only when a significant, urgent matter arises that needs shareholder...

October 21 2022 / 12 Minute Read

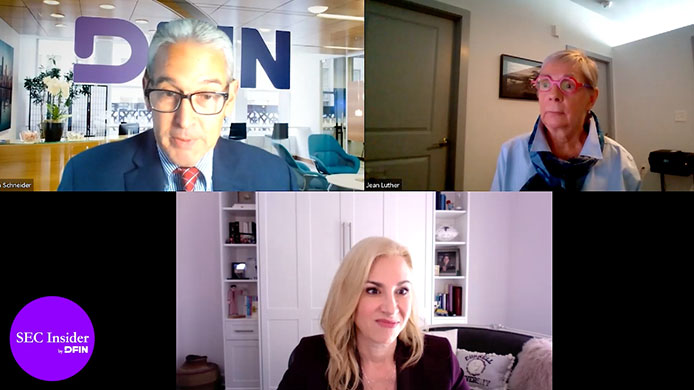

In SEC Insider by DFIN, Jean Luther, Mediant Director of Compliance, and Ron Schneider, DFIN Director of Corporate Governance Services, discuss...

September 30 2022 / 1 Minute Read

Americans are online more than ever these days, including more than 93% of adults, according to the Pew Research Center. What’s more, results from a...