Ready, Settle, Go: Reflections on Preparing for a Successful T+1 Launch

May 22 2024 / 9 Minute Read

May 28 is launch day for T+1 – the rule that will shorten the securities settlement cycle to trade date (T) plus one day. Currently, firms are...

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who We Serve

BetaNXT invests in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive, front-to-back securities processing, tax, and investor communications solution.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

Financial regulators in Europe have reviewed the functioning of SRD II, with input from issuers, investors and intermediaries. Areas for improvements were found and debated. While no changes have been made yet, firms handling EU-listed investments should understand the direction of the debate.

The European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) have assessed the scope and practical application of the new Shareholder Rights Directive (SRD II). The regulation upholds shareholder rights attached to companies listed in the European Union (EU). The review report, published in late July 2023, identified several areas for further improvement.

While no formal changes have been agreed upon, the report reveals where changes to the regulation might be made in a future update. Here is a summary of the key findings made by the authorities and the review’s respondents (issuers, investors and intermediaries):

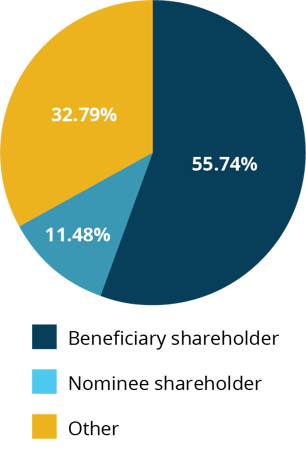

Currently, a lack of consistency exists between EU member states (MSs) about the definition of the shareholder. In some MSs, it is the individual beneficiary whereas others list it as the nominee, typically a retail broker. The lack of synchronization causes some challenges in determining who exercises shareholder rights.

While consistency would improve clarity, the ESMA says a common definition of the term “shareholder” would have a significant impact on MSs’ legal systems and that MSs will need to examine this very thoroughly.

Source: ESMA and EBA Report: Implementation of SRD II provisions on proxy advisors and the investment chain, July 2023

The review found that it is unclear whether SRD II rules cover funds in addition to equities, with inconsistencies in understanding among respondents.

The ESMA commented that a clearer and harmonized scope of eligible securities among MSs would reduce uncertainty about shareholder identification requests for securities other than those listed in the EU.

Almost all respondents underlined the opportunity to further mandate the use of a unique standard communications format, such as ISO20022. This would automate the flow of information along the custody chain, avoiding manual interventions that lead to delays and non-standardized information.

Responding intermediaries went further, insisting on a fully integrated obligation for issuers to initiate the shareholder identification process by sending a “golden operational record” to Central Securities Depositary (CSDs). The “golden operational record” is the single provision of operational information that allows all parties in the custody chain to process an event in exactly the same manner.

Not all firms have updated to the ISO20022 standard, but BetaNXT can handle this on their behalf. We can compare records supplied by custodians and CSDs, effectively supporting the provision of a golden record. We also recommend firms begin the shift to ISO20022 as older communications standards are being phased out.

Responding issuers said they face uncertainty regarding the total cost of a shareholder identification process, which reduces their incentive to initiate such a process. Brokers countered that shareholder identification is a matter for issuers, not regulators or intermediaries.

The brokers’ argument is that issuers have direct benefits in having the ability to contact their shareholders including: increased shareholder engagement, more participation in annual meetings, and when seeking a quorum in elections.

Responding investors reported problems receiving shareholder information via the intermediary chain with the required time frames. Either information arrived too late or was never received. Cited factors included: lack of digitalisation, uneven formatting, failures in the transmission of information, divergent national requirements, and separation between the legal title holder of the shares and the beneficial owner.

The recommendation was a fully harmonized obligation on the issuer to provide CSDs with a “golden operational record” in machine-readable format, containing all the information necessary to initiate any corporate event. BetaNXT can support issuers in meeting this recommendation.

Most respondents confirmed that SRD II has brought improvements with the facilitation of voting rights, but deadlines are too close to annual meeting notifications. Some asset managers noted they were often required to vote 10 to 15 days before the meeting, which is not ideal.

The original SRD set a deadline of 21 days between calling the meeting and publishing the meeting documentation. Adding custodians’ cut-off dates reduces the time available to shareholders to properly engage and vote on resolutions.

A general consensus emerged that one of the main obstacles is the lack of harmonization in the documentation required by intermediaries and custodians to prove the shareholders’ entitlement to exercise the rights attached to their shares. Further harmonisation was considered necessary by most respondents, especially investors and intermediaries.

Again, mandating the use of ISO20022 was highlighted as supporting this harmonization. The ESMA also observed that further automation of the process would be helpful, both at institutional and retail level, with the aim of simplifying the process and harmonizing regulatory oversight. BetaNXT can assist issuers with the communications tools and processes to facilitate longer deadlines.

Learn more in our latest SRD II whitepaper.

You can also find out more about the potential impact of the ESMA and EBA report findings and how BetaNXT can help by contacting us.

May 22 2024 / 9 Minute Read

May 28 is launch day for T+1 – the rule that will shorten the securities settlement cycle to trade date (T) plus one day. Currently, firms are...

November 16 2023 / 3 Minute Read

In a move that promises to reshape the landscape of the financial industry, the U.S. Securities and Exchange Commission (SEC) has finalized a...

September 20 2022 / 2 Minute Read

In November 2021, the Securities and Exchange Commission (SEC) approved a new rule that requires organizations to share proxy cards for contested...