Q&A Blog Series: A True End-to-End Shareholder Meeting Solution

May 03 2023 / 4 Minute Read

Unlike annual shareholder meetings, special meetings of shareholders are called only when a significant, urgent matter arises that needs shareholder...

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

Learn the genesis of each shortening of the settlement cycle, why T+1 is an event-driven mandate with a higher degree of complexity, and more.

On Tuesday, May 28, 2024, the first trading day after the U.S. Memorial Day holiday, regular-way settlement for U.S. equities, fixed income, and other select products will shorten from the current trade date (T) plus two business day cycle (T+2) to T plus one business day (T+1). A smooth and predictable settlement is essential to the global economy.

The whitepaper T+1: Why This Time Feels Different from T+2 examines how the drivers of the current move to T+1 differ from the 2017 move to T+2 in a few interesting ways that relate to settlement infrastructure. You’ll learn:

Fill out the form to read the whitepaper.

May 03 2023 / 4 Minute Read

Unlike annual shareholder meetings, special meetings of shareholders are called only when a significant, urgent matter arises that needs shareholder...

October 21 2022 / 12 Minute Read

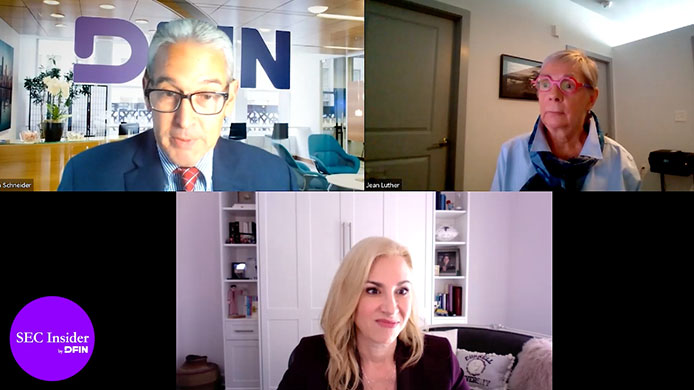

In SEC Insider by DFIN, Jean Luther, Mediant Director of Compliance, and Ron Schneider, DFIN Director of Corporate Governance Services, discuss...

September 30 2022 / 1 Minute Read

Americans are online more than ever these days, including more than 93% of adults, according to the Pew Research Center. What’s more, results from a...