BetaNXT’s CEO on Most Impactful Tech and 2025 Trends

November 20 2024 / 3 Minute Read

Bob Santella and Wealth Solutions Report discuss technologies impacting the industry, wealthtech in 2025, his vision for the firm, and more.

Our Capabilities

We believe the financial services ecosystem should seamlessly interconnect, without compromising quality or cost efficiency.

DataXChange

Fast-track your transformation and innovation with BetaNXT DataXChange, our cloud-based, real-time data management platform.

Who We Serve

BetaNXT invests in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive, front-to-back securities processing, tax, and investor communications solution.

Who is BetaNXT?

We invest in platforms, products, and partnerships to accelerate growth for the ecosystem we serve. Our connective approach empowers clients to deliver a comprehensive solution.

Leadership TeamEngage With Us

We’re talking to leaders about significant changes in the industry and their organizations – progress regarding product, process, technology, or culture. We’re curious about the how and the why. And we’re asking about what changes are next.

Stephen C. Daffron, co-founder & industry partner at Motive Partners and executive chairman of BetaNXT, highlighted critical changes he foresees for the industry in the coming years and the advancements he hopes to see. He also discussed the guidance he would offer to the next generation of rising stars and what developments within the industry have impressed him most.

Artificial Intelligence (AI) gets most of the headlines these days—as it should. The wealth management landscape is evolving rapidly to keep up with client demand for better products and services, faster and more accurate reporting, and advice tailored to the individual investor rather than a stereotype. Such hyper-personalization becomes economically feasible only with the level of detail and near real time responses that AI can provide.

Of course, AI is just the scouring wind we can feel—the power behind it comes from the cloud integration of massive, curated data sets and the automation of operational processes that were once time-consuming and manual. Such curated data allows the creation of the Large Language Models (LLM) that help reduce the delays and errors that contemporary clients will no longer tolerate. It will also drive down the unit cost of delivering those products and services because it references a more detailed set of self-correcting, contextually coherent data thus reducing the need for constant manual reconciliation.

I believe that AI-managed wealth advice will soon become the rule rather than the exception, but it is not without risk. There is a right way and a wrong way to develop and implement AI. Remember this basic rule: AI is only as good as the data it models. If you focus on the curation, security, and integrity of the data powering AI rather than rushing it into your advisors’ scripts and your operational flow, you will achieve better results and avoid the pitfalls we are now seeing play out in headlines within the industry.

The demand for the personalization of advice is trending strongly and I expect it to strengthen. Leading contemporary firms recognize that modernizing their data and technology architecture is critical to meet this accelerating market demand.

These firms are aggressively marketing this capability, and clients of all firms now perceive that it is possible to offer personalized advice in near real time and are dissatisfied when it is not. Therefore, every wealth management enterprise is under pressure to develop solutions that speed up processes, enhance personalization, and digitize data comprehensively.

These leading firms are exceptional but are not the norm for the U.S. market. For most U.S. wealth management clients, today’s advisor solutions consist of fragmented, unreconciled data sets being processed by technology stacks that don’t talk to each other so the advisor cannot provide a cohesive view of data to the investor.

To exacerbate the issue, the constant data reconciliation and manual operations increase the enterprise costs making it difficult to deliver the seamless near-real-time answers that modern clients increasingly expect. Integrated data systems and data integrity are key to preventing this type of scenario but for most firms they remain aspirational. It makes no difference how good your advisor tools are if the data that feeds them is flawed, delivered late, or provided in a format the advisor and the client cannot use.

In the Watergate Saga, the solution was found by “following the money.” My advice to the industry’s up-and-coming talent is to learn to “follow the data.” To be successful in the next iteration, our stars should prioritize the quality of data as a critical component of improving client experience, inclusive of or not limited to user design and user experience. The latest technological trends will always drive interest and engagement, but you must focus on the ultimate objective: does your solution provide accurate, real-time answers? If the answer is “no,” then doing what is necessary to make the answer a sincere “yes” should be your No. 1 task.

Wealth advisors (and the leaders of wealth management firms) often blame the tools available for mistakes or delays, when the real issue generally lies with the unreliable data powering that solution. In my experience, a lack of data governance can be as damaging to a wealth management firm’s reputation as a lack of training or compliance.

While working with complex data sets can be challenging, data that is unreliable or inaccurate can ruin the client relationships that are the foundation of every enterprise. Data is one of the most important components—and differentiators—of a wealth enterprise, and it requires a lot of care and attention. That is perhaps one of the most important tips for our industry’s young and up-and-coming talent.

Source: Connect Money

November 20 2024 / 3 Minute Read

Bob Santella and Wealth Solutions Report discuss technologies impacting the industry, wealthtech in 2025, his vision for the firm, and more.

November 13 2023 / 8 Minute Read

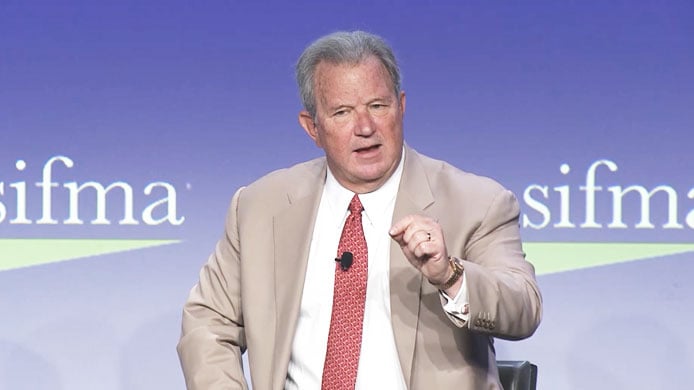

A conversation with Stephen Daffron, Chairman & CEO of BetaNXT and Joe Seidel, Chief Operating Officer of SIFMA on the current shifting...

May 16 2023 / 23 Minute Read

As technology supercharges data access and transparency, opportunities to bring the benefits of sound investing to more individuals multiply....